Solar Panels Utah Tax Credit

Renewable energy systems tax credit.

Solar panels utah tax credit. If you install a solar panel system on your home in utah the state government will give you a credit on your next year s income. Rooftop solar for your business. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum of 2 000. Utah s solar tax credit makes going solar easy.

Dolla dolla bill y all. Get form tc 40e renewable residential and commercial energy systems tax credits from the governor s office of energy development with their certification stamp. The residential energy credits are. The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

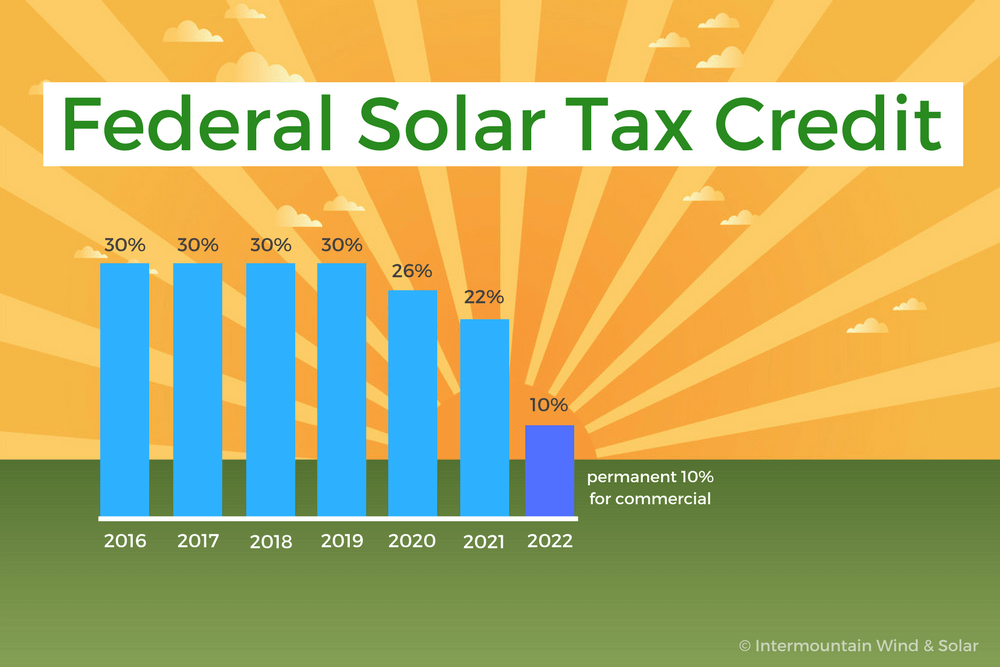

The federal solar energy tax credit is a tax credit that s available if you decide to install a solar system. Qualifying for the utah solar tax credit. Jeremy peterson has introduced legislation hb 23 to phase out the solar portion of utah s renewable energy tax credit for homeowners the tax credit helps utah families and businesses install solar geothermal and wind energy systems helping homeowners and businesses become more energy self reliant while creating new jobs and cutting pollution. With available tax credits from both state and federal governments now is the best time to invest in solar energy for your home.

Utah renewable energy systems tax credit restc program. Energy costs are expected to increase. All of our customers qualify for the u s. The credit is applied to the following tax year so if you spend 10 000 on a new solar system you ll be able to take a.

Do not send this form with your return. Renewable commercial energy systems credit code 39 utah code 59 10 1106. Utah solar tax credit. And of course utahns also benefit from the federal solar tax credit.

A rooftop solar tax credit is also available for larger. 30 of the costs of equipment permits and installation can be claimed back via your federal tax return. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. The utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is less.

For utah solar shoppers state and local tax credits mean there s never been a better time to start exploring solar offerings. Learn more and apply here. Federal tax credit it s technically called the investment tax credit utah customers qualify for a state tax credit in addition to the federal credit. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

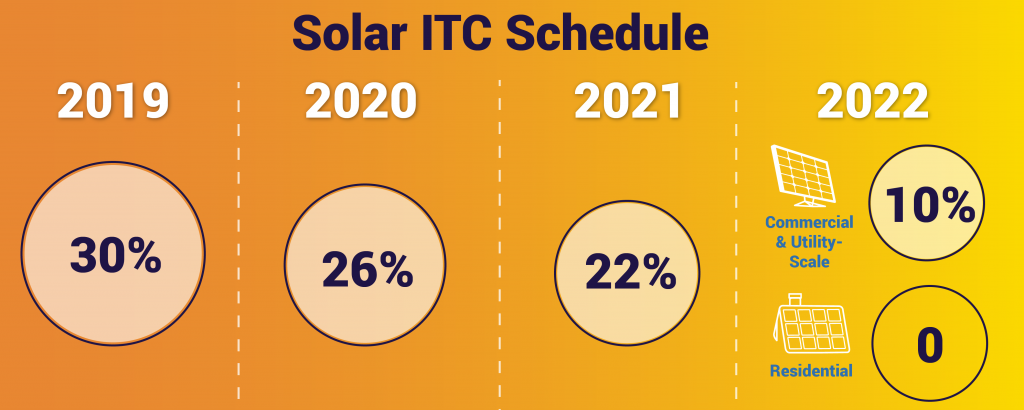

Over the next few years both solar incentives will be decreasing in value until they expire.

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/ZZSMTHNLHJCJROSNTVBVZODORQ.jpg)

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/KI7PZRE5TJBILC4QLF3SEI362Q.jpg)