Step Up Cd Investopedia

/smiling-businessman-in-discussion-with-client-in-office-907066340-edaafd1950ca4ee28852db969e12f613-ffd86543b2d641d8a155c143bf64e854.jpg)

A step up bond is a bond that pays a lower initial interest rate but includes a feature that allows for rate increases at periodic intervals.

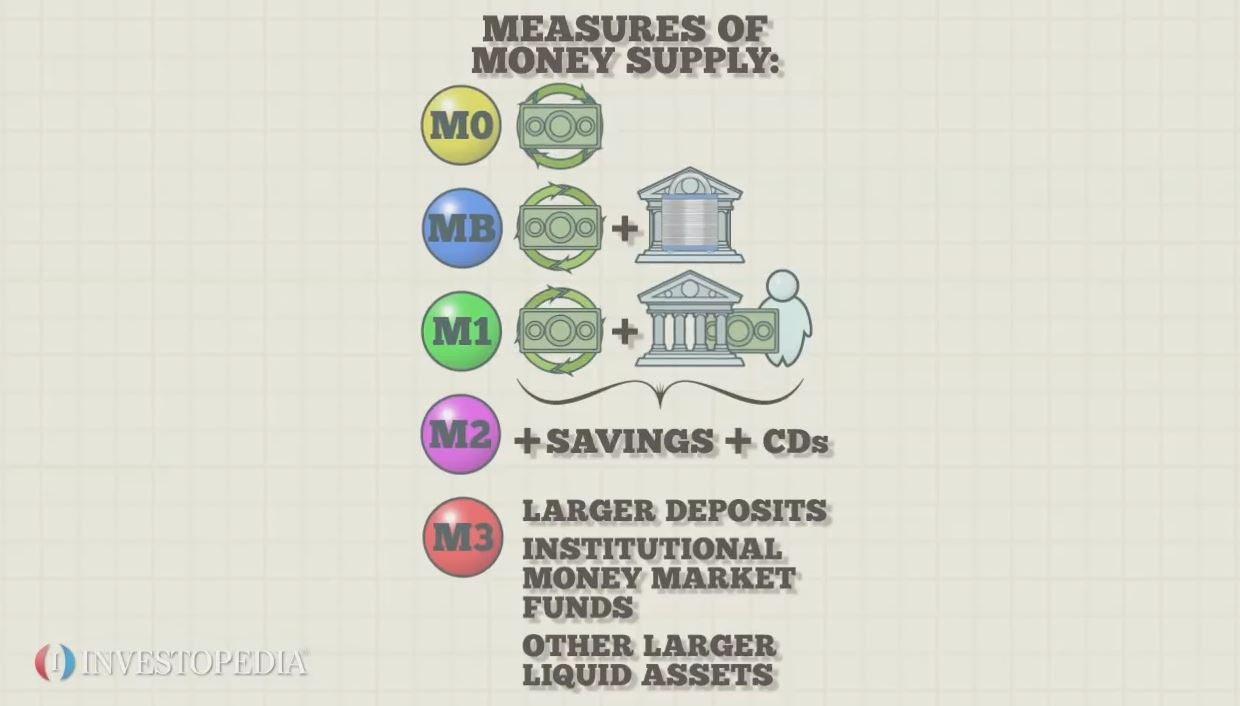

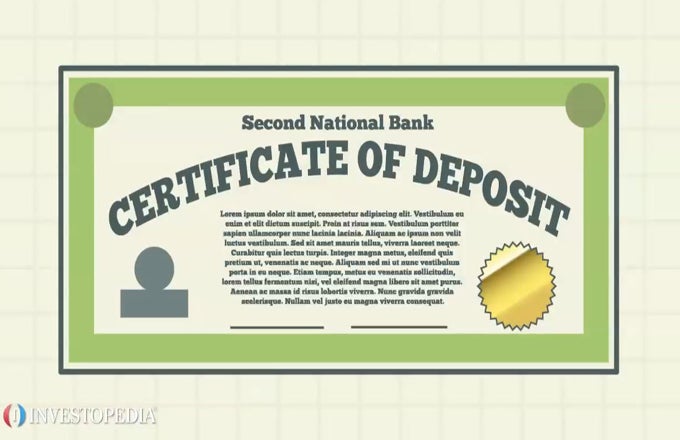

Step up cd investopedia. A step up in basis is the readjustment of the value of an appreciated asset for tax purposes upon inheritance. A strategy in which an investor divides the amount of money to be invested into equal amounts to certificates of deposit cds with different maturity dates. Before the cd matures the interest rate associated with the. 1 the higher market value of the asset at the time of inheritance is considered for.

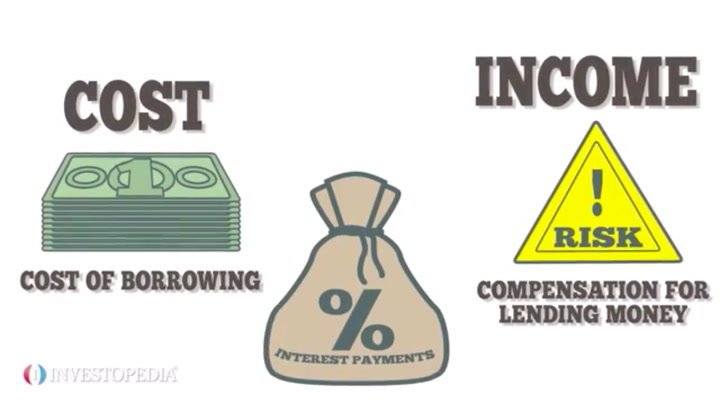

What is a step up bond. A step up cd which can also go by other names such as step rate goes some distance to addressing this by lifting its apy at specific pre defined intervals. The bump up certificate of deposit bump up cd yields a lower rate than that of a similar certificate of deposit cd with no bump up option. Step up and step down cds are investment opportunities that offer investors a fixed interest rate for a certain amount of time.

After this time the interest rate automatically increases or decreases to a predetermined interest rate. This strategy decreases. A certificate of deposit that allows the bearer to deposit additional funds after the initial purchase date that will bear the same rate of interest. The number of intervals and the.

Every seven months the interest rate increases during this cd s 28 month term. A step up cd is a deposit account that allows savers to lock in an interest rate for a set number of months. In most cases the amount of time is one year. Bump up cds are also called step up cds.

Step up your cd interest rate at u s.

:max_bytes(150000):strip_icc()/Capitulation12-d3efb4191a234673a04dc23340bb9f7e.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Swap_Spread_Apr_2020-01-9ff4068939e742ca9cc066d6d7d481b3.jpg)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

:max_bytes(150000):strip_icc()/AnIntroductiontoStructuredProducts1-1a2eea05ef064d3fae32c8e1de618eaa.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Stock_2020-01-03fbeb0664c74b71aa025dcfd7661c82.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

:max_bytes(150000):strip_icc()/Supplyrelationship-c0f71135bc884f4b8e5d063eed128b52.png)

:max_bytes(150000):strip_icc()/PriceValueofaBasisPoint-792207af2f5e4f20996943f71a133025.png)

/investment-3999136_1920-7e692563c3ea473d968c27d90ba7c5c6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Timing_Tips_Every_Investor_Should_Know_Jul_2020-01-b5f22b7362b34a17a4e93edb184a9460.jpg)

/INVESTOPEDIAMAR2020pdf-494af5483a9e41ce89d47f63ce0d190b.jpg)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

:max_bytes(150000):strip_icc()/ufb_inv-c7c833fc6db04ee6afdd0706cc4fee10.png)

.png)

:max_bytes(150000):strip_icc()/marginal_rate_of_substitution_final2-893aa48189714fcb97dadb6f97b03948.png)

:max_bytes(150000):strip_icc()/pola-4de0b33c9a0f4823a961104a3c92aceb.png)

/Review_INV_tradestation-a5056e51452847d8be3d7e945b52f929.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg)

:max_bytes(150000):strip_icc()/PICKSTOCKSJPEG-1a17970ec2ea4b05a4119b578770977c.jpg)

/td-bank_inv-7df702a485c44ae4ab2af157e62fc82c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_CMO_vs_CDO_Same_Outside_Different_Inside_Mar_2020-01-4f927e0a330e476897b540410c318ace.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Introduction_To_Counterparty_Risk_Feb_2020-02-5477c45c30ee48b4b09617f3b88300f4.jpg)

/Review_INV_td_ameritrade-d1aea404b12846889442dee20071a45f.png)

/Review_INV_interactive_brokers-04c70bf832174919a79ebf54cdd448c5.png)

/wellstraderecirc-6ac6f5387c474c7599d598349a255ea8.png)

/Review_INV_ally_invest-f3ed33ae9d5f4e779eff49146e71bb6f.png)

:max_bytes(150000):strip_icc()/sallie-mae-inv-6f13bd8d0ad941b08d2f89759e72972c.png)